Locate the Perfect Mortgage Broker for Your Home Car Loan Needs

Choosing the appropriate home mortgage broker is an important step in the home financing process, as the experience and resources they give can considerably influence your financial end result. Recognizing where to start in this search can commonly be overwhelming, increasing the inquiry of what specific high qualities and qualifications really set a broker apart in a competitive market.

Comprehending Mortgage Brokers

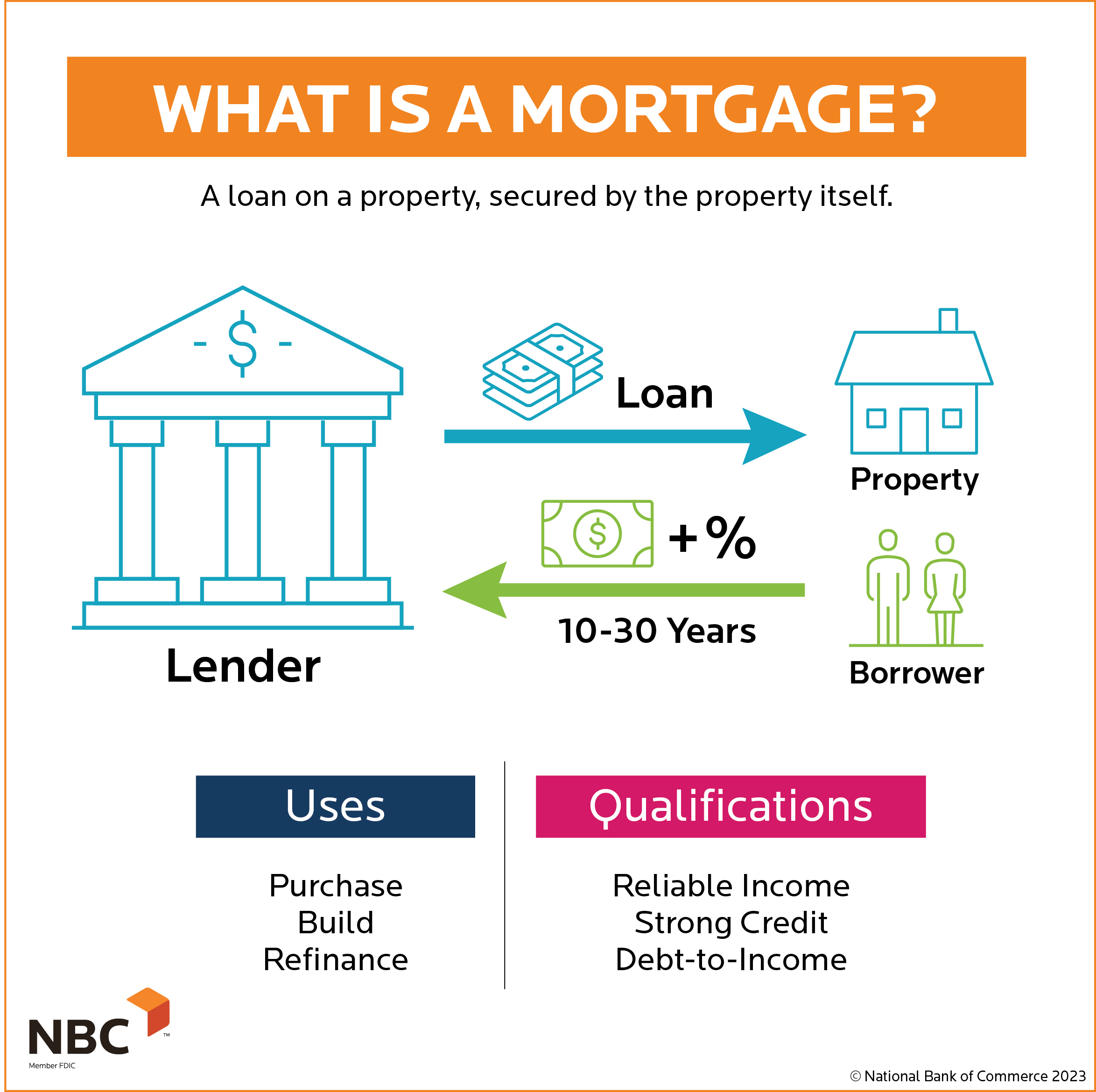

Recognizing mortgage brokers is important for browsing the intricacies of home funding. Home loan brokers work as middlemans between borrowers and loan providers, facilitating the process of protecting a home mortgage. They possess extensive knowledge of the financing landscape and are knowledgeable at matching customers with suitable car loan products based on their financial accounts.

A key function of home mortgage brokers is to analyze a debtor's financial circumstance, consisting of credit history, earnings, and debt-to-income proportions. This evaluation enables them to advise home mortgage choices that align with the debtor's abilities and requirements. Furthermore, brokers have access to a selection of lending institutions, which enables them to existing multiple financing choices, potentially leading to a lot more favorable terms and prices.

In addition, home mortgage brokers enhance the application process by aiding with the required documents and interaction with the loan provider. Their experience can likewise confirm very useful in navigating regulatory requirements and industry modifications. By utilizing a home loan broker, borrowers can save time and decrease stress, guaranteeing an extra informed and efficient home financing experience. Comprehending the duty and advantages of home loan brokers eventually equips buyers to make educated choices throughout their mortgage trip.

Key Top Qualities to Seek

When selecting a home loan broker, there are a number of crucial qualities that can substantially influence your home funding experience. Look for a broker with a solid reputation and favorable customer testimonials. A broker with satisfied clients is likely to offer dependable solution and sound suggestions.

A broker with comprehensive sector expertise will be much better geared up to navigate complex mortgage alternatives and offer tailored options. A broker who can plainly clarify terms and procedures will certainly ensure you are knowledgeable throughout your mortgage journey.

An additional important quality is openness. A trustworthy broker will openly review charges, possible conflicts of rate of interest, and the whole loaning procedure, enabling you to make educated decisions. Search for a broker that demonstrates strong settlement skills, as they can safeguard much better terms and rates on your part.

Finally, consider their schedule and responsiveness. A broker who prioritizes your needs and is readily easily accessible will make your experience smoother and much less stressful. By examining these key high qualities, you will be better positioned to find a home mortgage broker who lines up with your home mortgage demands.

Questions to Ask Potential Brokers

Selecting the best home mortgage broker involves not only identifying crucial top qualities yet additionally engaging them with the ideal questions to gauge their proficiency and fit for your requirements. Begin by asking about their experience in the industry and the sorts of lendings they specialize in. If they line up with your specific financial scenario and goals., this will certainly assist you comprehend.

Ask about their procedure for evaluating your monetary wellness and determining the very best mortgage options. This inquiry exposes how complete they are in have a peek at this site their method. In addition, ask regarding the series of lenders they function with; a broker who has access to numerous lending institutions can provide you more competitive prices and alternatives.

You must also review their cost framework. Recognizing how they are compensated-- whether through ahead of time fees or commissions-- will certainly offer you insight right into potential conflicts of rate of interest. Ultimately, request for references or testimonials from previous clients. This can give useful info regarding their reliability and customer support. By asking these targeted concerns, you can make a more educated decision and discover a broker that finest matches your home loan demands.

Researching Broker Credentials

Extensively looking into broker qualifications is a critical action in the mortgage selection process. Ensuring that a home loan broker has the suitable certifications and licenses can considerably influence your mortgage experience - Mortgage Loans. Begin by verifying that the broker is licensed in your state, as each state has details demands for home loan professionals. You can commonly find this information via your state's governing agency or the Nationwide Multistate Licensing System (NMLS)

In addition, discovering the broker's experience can give understanding into their expertise. A broker with a proven track document in successfully closing car loans comparable to yours is invaluable.

In addition, explore any kind of disciplinary activities or complaints lodged versus the broker. On the internet evaluations and endorsements can offer a look right into the experiences of past clients, helping you analyze the broker's online reputation. Ultimately, comprehensive study into broker qualifications will empower you to make an educated decision, promoting self-confidence in your home mortgage procedure and boosting your total home getting experience.

Evaluating Fees and Solutions

Reviewing charges and solutions is usually a crucial component of picking the right home loan broker. Transparency in cost frameworks permits you to contrast brokers effectively and analyze the total cost read more of getting i thought about this a mortgage.

In enhancement to fees, take into consideration the array of services supplied by each broker. Some brokers supply an extensive suite of solutions, including economic assessment, aid with documents, and recurring support throughout the lending procedure.

When reviewing a broker, ask about their responsiveness, readiness, and schedule to respond to questions. A broker who focuses on customer care can make a significant difference in navigating the intricacies of home loan applications. Inevitably, understanding both costs and solutions will certainly empower you to select a mortgage broker that aligns with your financial needs and assumptions, guaranteeing a smooth path to homeownership.

Conclusion

In verdict, selecting a proper home loan broker is essential for accomplishing favorable finance terms and a structured application procedure. Ultimately, a trustworthy and knowledgeable home mortgage broker offers as a valuable ally in navigating the intricacies of the home loan landscape.

Picking the best home mortgage broker is an important action in the home loan process, as the know-how and resources they provide can substantially influence your economic result. Home loan brokers serve as middlemans between lenders and consumers, assisting in the procedure of securing a home loan. Comprehending the role and advantages of home mortgage brokers inevitably empowers property buyers to make enlightened choices throughout their home loan journey.

Guaranteeing that a mortgage broker has the proper qualifications and licenses can substantially affect your home lending experience. Inevitably, a educated and credible mortgage broker serves as an important ally in navigating the intricacies of the home mortgage landscape.